It was a bad, bad idea for the government to run this automobile

Maintaining a majority stake in a struggling G.M. as the 2012 election approaches will only increase the liability. If G.M. has to use taxpayer money to bail out Opel and Daewoo, its Korean division (which lost billions on currency speculation, no less), the issue of bailout money being sent abroad will undoubtedly be a campaign issue.I wonder if the logic is why worry about tens of billions of dollars in debt, when we are piled high in gazillions of dollars of debt.

G.M.’s global interests are far too diverse for it to serve its taxpayer owners faithfully, and it can’t afford to subjugate its business prerogatives to the political needs of its major shareholder in the White House. So, unless Americans develop a sudden obsession with G.M.’s $40,000 Volt electric car just in time for an I.P.O., taxpayers will be stuck with tens of billions of dollars in losses.

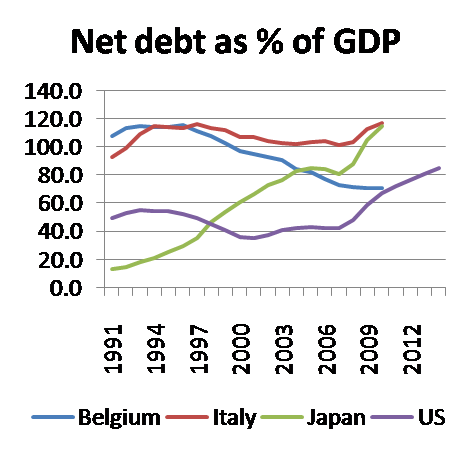

Speaking of debt, Paul Krugman chips in with we have no reason to worry; after all, Belgium, which will soon preside over the EU, is mired in a lot of debt, and provides this chart.

Ahem, while what was good for GM 60 years ago might have been good for the US then, what is good for Belgium being good for the US now? Seriously, what happened to Krugman?

And, another page in the NY Times wants us to be afraid, really really afraid, of the debt situation:

With the national debt now topping $12 trillion, the White House estimates that the government’s tab for servicing the debt will exceed $700 billion a year in 2019, up from $202 billion this year, even if annual budget deficits shrink drastically. Other forecasters say the figure could be much higher.So, who you gonna believe? :-)

In concrete terms, an additional $500 billion a year in interest expense would total more than the combined federal budgets this year for education, energy, homeland security and the wars in Iraq and Afghanistan.

No comments:

Post a Comment